Business owners and self employed contractors are allowed to offset the business miles they travel against their taxable income. This is brilliant in principle but can be a nightmare when it comes to keeping a track of the miles.

This post is about our system and what we do keep tabs on the mileage we do. We travelled over 20,000 miles last year for business, so it was imperative to have a good system.

HMRC allows 40p per mile for first 10,000 miles and 25p thereafter. If you travel a lot with your business then this can be a good tax saver for you. The real difficulty comes in when you need to keep a log of the miles.

We tried several things to log our miles. There were number of mobile apps that we used, but found that they weren’t convenient for logging mileage.

When arriving at viewing, the agent was often already there and there was no time to open the phone, find the app, navigate to the appropriate screen and log in the miles. We tried logging in the mileage after the viewing, but then, very often we had several viewings with the same agent one after another, so we often ended putting in some of the miles we travelled but not all.

As we travel 168 miles one way to our investment area, that’s almost £70 of mileage allowance. Then there is travel around the area, and the trip home, so we could be looking at near £200 mileage claim per trip. It can really add up when you travel once a week, so it was important that we log everything.

Then we had a chat with other investors and accountants to find what they’re doing in regards to mileage claims. The most common answer was that they keep a journal in the car.

This sounded like a good idea, but then we thought, how will we know when we reached our 10K allowance? Going through the journal to add up everything will be a waste of time. So, we figured a spreadsheet would be a good companion.

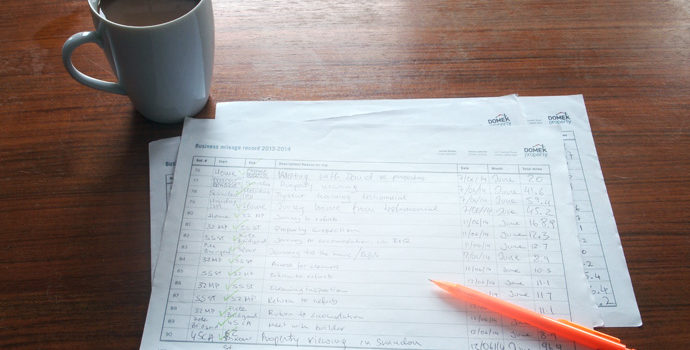

The mileage claim is regulated by HMRC, so we took advice from our accountant and bookkeeper in regards to good practice and I set out to design our mileage log book which we always keep in the car. I also found a very useful spreadsheet, kindly offered by Fylde Tax Accountants, which we have on our computer and update it on regular basis.

The system now

We print our log book on 1 double sided page of A4. This, along with a pen, lives in the glovebox of our car. This give us 30 journeys to log per sheet. This is very important because it takes only about 15 minutes to log these journeys into our spreadsheet and one thing we don’t want to do is spend hours on duplicating data onto the computer.

Once the double sided logbook is filled, we bring it back from the car and record it in our spreadsheet. The log book goes into to the archive folder and I print another double sided logbook to take to the car.

Doing smaller chunks of mileage claimed on regular basis proves to be a time saver in a long run.

If you would want a copy of our log book, please click here. I would only say, please check with your accountant before using this system. Until next time.